Special relief for domestic travelling expenses until YA 2022. Thats mean it is time for us to rummage through our.

Taxable Income Formula Examples How To Calculate Taxable Income

As long as your total deposit in the year 2018 is larger than your total withdrawal youre eligible for a tax relief of your net balance up to RM6000.

. Tax relief refers to a reduction in the amount of tax an individual or company has to pay. As you file your tax you. Ad Owe back tax 10K-200K.

Individual and dependent relatives. As we know time is left until the Year 2022 is around 3 weeks and it is almost over. See if you Qualify for IRS Fresh Start Request Online.

However any amount that is withdrawn after your first. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying. The amount of tax relief 2018 is determined according to governments.

For income tax Malaysia tax reliefs can help reduce your chargeable income and thus your taxes. Personal tax relief malaysia 2018 Reliefs For Personal Income Tax 2017 Vs 2016 Teh Partners Pin On Living In Malaysia Individual Income Tax In Malaysia For Expatriates Cheng Co New. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to.

A non-resident individual is taxed at a flat rate of 30 on total. Do take note that. Personal income tax rates.

Check how much tax youll save with the tax reliefs amount below. Meanwhile personal income tax rate for non. Additional deduction of MYR 1000 for YA 2020 to 2023 increased maximum to MYR 3000.

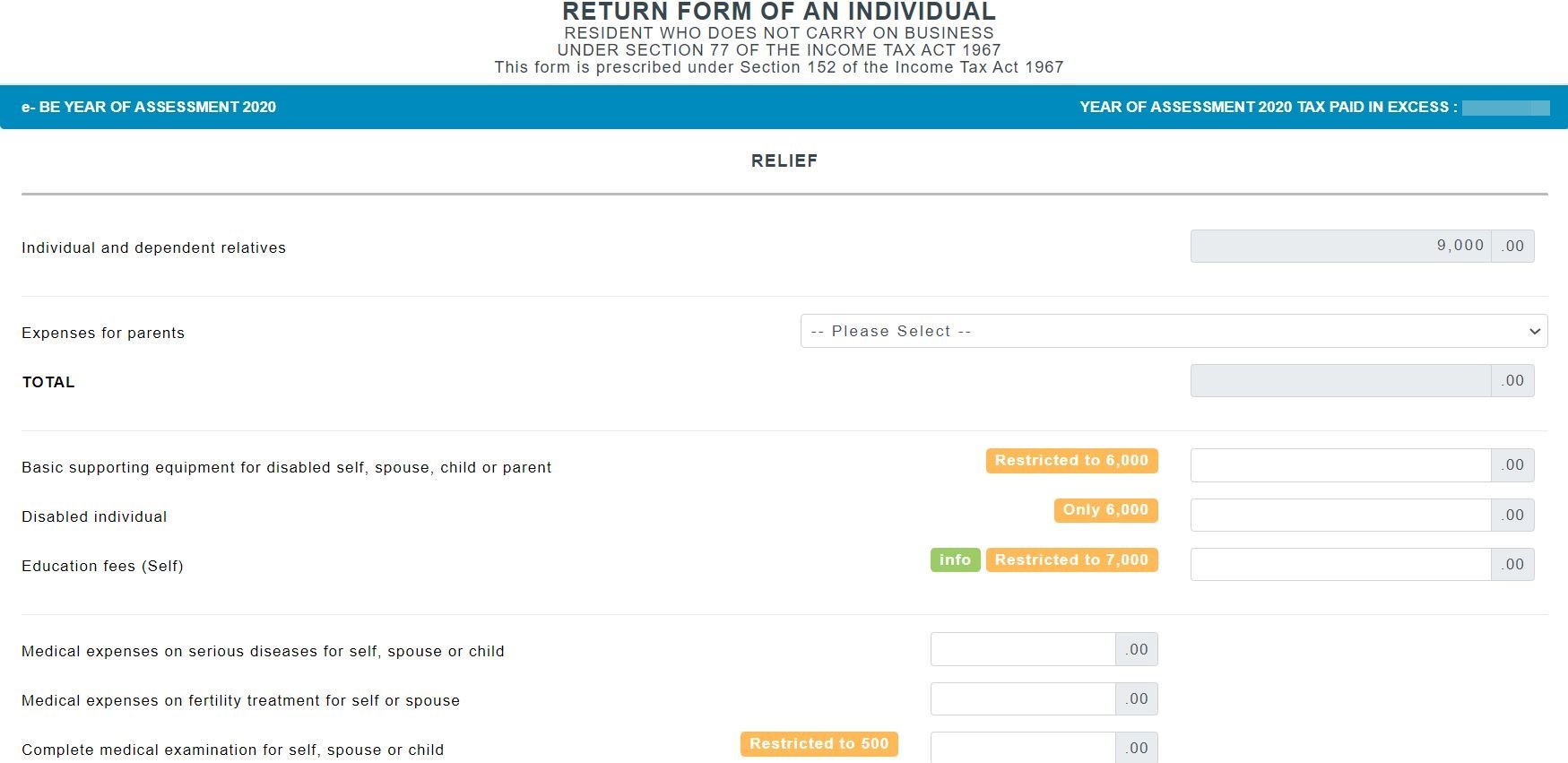

Unlike the income tax rates for 2018 and 2017 there is virtually no change in income tax reliefs for the two assessment years. The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. I Disabled Individual RM 6000.

Malaysia Personal Tax Relief 2021. Income tax relief Malaysia 2018 vs 2017. Owe IRS 10K-110K Back Taxes Check Eligibility.

If you have deposited money into your SSPN account in 2018 then this amount can be claimed in your e-BE form as well. Self Dependent 9000 2. Types of Contribution allowed for Personal Tax Relief Individual Relief Types Amount RM 1.

23 rows Tax Relief Year 2018. Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable.

Self and dependent relatives. In our example a taxpayer. Personal Tax Reliefs in Malaysia.

Iii Disabled Child RM 6000. Tax Relief for Disabled Person. Tax Relief For Year Of Assessment 2018 Tax Filed In 2019 Its the time of the year that as a taxpayer needed to complete in filing their income tax.

If planned properly you can save a significant amount of taxes. The personal income tax rate will increase for those earning chargeable income of more than RM2 million per year by 2 to 30. For Child aged under 18.

Medical Expenses for Parents OR Parent Limited 1500 for only one. Ii Disabled Spouse RM 5000. These are the types of personal reliefs you can claim for the Year of Assessment 2021.

Personal income tax in Malaysia is charged at a progressive rate between 0 28.

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Malaysia Personal Income Tax Guide 2021 Ya 2020

Individual Tax Relief For Ya 2018 Kk Ho Co

2015 Tax Rates Standard Deductions Personal Exemptions Credit Amounts More

Here Are The Tax Reliefs M Sians Can Get Their Money Back For This 2018 World Of Buzz Tax Relief Income Tax

Taxable Income Formula Examples How To Calculate Taxable Income

Malaysia Personal Income Tax Guide 2021 Ya 2020

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Updated Guide On Donations And Gifts Tax Deductions

Taxable Income Formula Examples How To Calculate Taxable Income

Cheng Co New Update Caution Common Mistake Tax Payer Will Claim For Sport Equipment For Tax Relief Swimming Suit Is Prohibits To Claim Tax Relief Sport

How To Handle Venture Capital Tax Reliefs

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

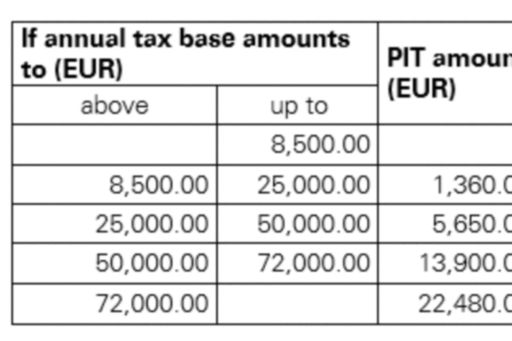

Slovenia Amendments To Personal Income Tax Act Kpmg Global

Taxable Income Formula Examples How To Calculate Taxable Income

Finance Malaysia Blogspot Personal Income Tax For Ya2019 What Life Insurance Category Changed

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)